Who Will Claim the Throne Among Content Providers?

Summary: Streaming content providers are plenty, and maintaining subscriber growth and rising content costs are challenges they all face.

With the eighth and final season of Game of Thrones coming to a wrap, the hype surrounding this award-winning television series has been enormous. Whether or not you are part of the 30 million viewers that have been following the blood feuds and rivalries or George R. R. Martin’s Song of Ice and Fire, the show’s “win or die” truism would appear to have broad applicability, well beyond Westeros.

The stage for a real-life war among content streaming providers is set as well. The prize here is not some rusty throne cast from the swords of a thousand vanquished opponents. Rather, it’s an ever-growing market of streaming media customers. Consumers keep “cutting the cord” from “take-it-or-leave” bloated, conventional programming bundles, creating a huge opportunity for the winner.

- In 2018, 69 percent of U.S. households already had a subscription to Netflix, Amazon Prime or Hulu, up from 52 percent in 2015,1 and

- 21 percent of broadband homes that still had a pay TV service were at least considering canceling their service in the next six months1

Fierce competition

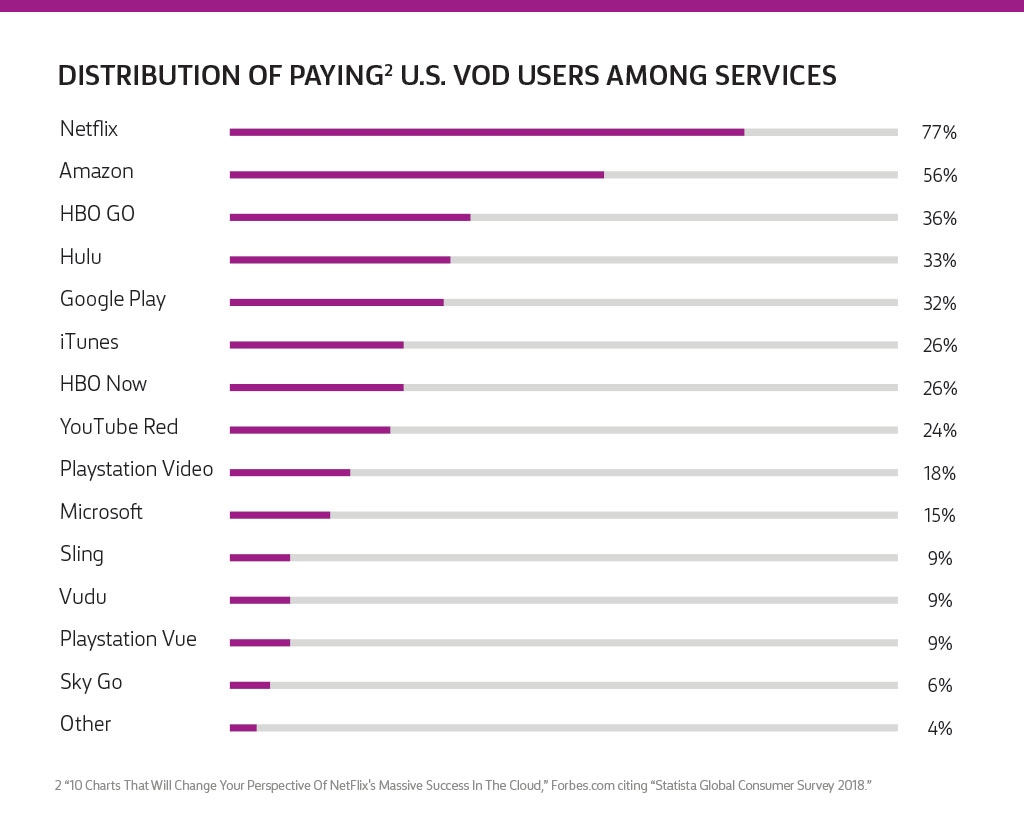

Of course, reality is stranger than fiction. The number of companies with claims to the content “throne” is much greater than the six kings and queens vying for the iron throne. With so much future revenue at stake, greater competition, from both incumbents and new entrants, is here in the form of new offers. Many would agree this space has already become over-crowded with established brands and potential disruptors. Consider the intense competition to deliver Video on Demand (VoD) services in the U.S.:2

More competition is also emerging from “old school” pay TV providers; desperate to retain customers and revenues, they are finally motivated to break up “one size fits all” programming bundles into more tailored packages or à la carte offers and include subscriptions to popular streaming sites within their own service bundles.

Regardless of ancient origins in the pay TV world, or new origins in the world of digital streaming, content providers will face common challenges—maintaining subscriber growth and rising content costs—and these challenges will be further exacerbated by the very nature of the competition.

In 2018, 69 percent of U.S. households already had a subscription to Netflix, Amazon Prime or Hulu, up from 52 percent in 2015.

Winning the battle

To stay in the fight, streaming providers must continue to focus on technological innovations. However, to win the war, they must give the greatest focus to the one point of potential differentiation—customer experience. Ultimately, the experience of consuming content is more important than the technology that delivers it. How consumers feel about that experience is what forms the core of the value proposition. While the content itself is a chief component in a customer’s experience, often taken for granted is the connectivity that delivers this awesome content (hint: that’s where we fit in the experience).

Which content providers will be successful in the technology and subscription models that create an experience that compels customers to want more content, and—specifically—to want that content from them? Time will tell.

Game of Thrones may be able to spawn a successful “prequel” series, but content providers can only move forward in time. Winter is coming—who will live to see the spring?

1 Mike Snider, “Avoiding the cold? You may as well binge. Streaming video is only going to grow in 2019,” USAToday.com (3 Jan. 2019).

2 “10 Charts That Will Change Your Perspective Of NetFlix’s Massive Success In The Cloud,” Forbes.com citing “Statista Global Consumer Survey 2018.”

Key takeaway: To stay competitive, streaming providers must focus on technological innovations while remembering the crucial differentiation—customer experience.